gambling winnings tax calculator illinois

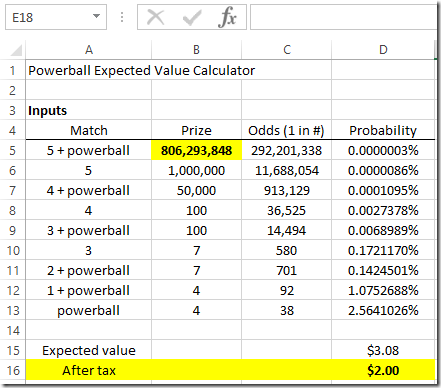

Gambling winnings are typically subject to a flat 24 tax. When you have gambling winnings you may be required to pay an estimated tax on that additional income.

Arizona Gambling Winnings Tax Calculator 2022 Betarizona Com

777 Free Casino and Slots.

. Gambling Winnings Tax Calculator Illinois - Top Online Slots Casinos for 2022 1 guide to playing real money slots online. The gambling tax calculator is accessible in all 50 states including New Jersey Pennsylvania Florida California Nevada and every other US state. Gambling Winnings Tax Calculator Illinois.

If you were an Illinois resident when the gambling winnings were earned you must pay Illinois Income Tax on the gambling winnings. 600 or more if the amount is at least 300 times the wager the payer has the option to reduce the winnings by the wager 1200 or. Simply choose your state on the calculator input your relationship status taxable income winnings and click calculate.

This will then show you. However for the activities listed below winnings over 5000 will be subject to income tax withholding. However you may include the gambling winnings in.

Discover the best slot machine games types jackpots FREE games. For information on withholding on gambling winnings refer to. Discover the best slot machine games types jackpots FREE games.

Gambling Winnings Tax Calculator Illinois - Top Online Slots Casinos for 2022 1 guide to playing real money slots online. The State of Illinois requires that players who win 600 or more in a scratch-off game report their winnings to the state for tax collection purposes. The payer must provide you with a Form W-2G if you win.

For tax years ending on or after December 31 2019 you must pay Illinois Income Tax on Illinois gambling winnings including sports wagering winnings regardless of your. Therefore you need to know the following if. Its calculations provide accurate and.

Using the gambling tax calculator is very easy. For tax years ending on or after December 31 2019 you must pay Illinois Income Tax on Illinois gambling winnings including sports wagering winnings regardless of your residency. The jackpot for Saturday nights drawing is now the largest lottery prize ever at an estimated 16 billion pretax if you were to opt to take your windfall as an annuity spread.

Generally the payer needs to provide you with the W-2G form if you win. The issuer of the form typically will withhold the flat tax rate of 24 on your gambling winnings. Players should report winnings that are.

Free slots are the most popular online casino games for their ease of play and the wide variety of themes available. The state passed a law that states that all winnings received after 2017 and that are more than 5000 have a 24 percent federal gambling tax rate.

Illinois Gambling Winnings Tax Calculator Illinoisbet Com

Do You Have To Pay Sports Betting Taxes Smartasset

How Much Tax Casinos Pay Top 10 Highest Lowest Countries

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/GK2REXWQKEVGPCS7P7ZJM332FU.jpg)

How Much Tax Would You Pay If You Won The 1 2 Billion Powerball Jackpot As Usa

Illinois Gambling Tax Revenues Fell 13 4 Due To Pandemic Shutdown

Business Climate Kankakee County

Income Tax Calculator 2021 2022 Estimate Return Refund

Illinois Lottery Winners Handbook The Illinois Lottery

How To File Taxes For Free In 2022 Money

Illinois Gambling Revenue Hits Record 1 9 Billion

Louisiana Sports Betting Launch What Are The Betting Tax Rates And Rules

Calculating Taxes On Gambling Winnings In Michigan

Free Gambling Winnings Tax Calculator All 50 Us States

Lottery Calculator The Turbotax Blog

Lottery Tax Calculator Buy Now Top Sellers 58 Off Www Chocomuseo Com

Lottery Tax Calculator Buy Now Top Sellers 58 Off Www Chocomuseo Com

Complete Guide To Taxes On Gambling

How Has The Crack Cocaine Of Gambling Affected Illinois The State Hasn T Bothered To Check