puerto rico tax incentives act 22

They are not a quick tax savings scheme. The tax breaks fall under a law known as Act 60 a version of which was initially enacted by the Puerto Rico government under another name in 2012 as the island faced a looming economic collapse.

Many high-net worth Taxpayers are understandably upset about the massive US.

. Puerto Rico the District of Columbia and tribes through replacing school buses medium- and heavy-duty trucks and other diesel. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022. Puerto Rico Spanish for rich port.

Section 179 deduction dollar limits. Read all the details and an honest review of the programs here. Companies officially operating under the Act see their Export Services Income ESI taxed at a reduced rate of 4.

Puerto Rico Real Estate Puerto Rico Luxury Real Estate 4 Sale. Boriken Borinquen officially the Commonwealth of Puerto Rico Spanish. The Ultimate Guide to Act 20 and Act 22.

And west of San LorenzoCayey is spread over 21 barrios plus Cayey Pueblo the downtown area and the. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. Act 20 and 22 tax incentives have been replaced by Act 60 as of January 1 2020.

Act 52 tax will replace the Act 154 excise tax on the revenues of foreign corporate subsidiaries based in Puerto Rico. Those two tax acts offer low to no taxes on certain types of income. Taxes levied on their employment investment and corporate income.

Puerto Rico US Tax. East of Aibonito and Salinas. In this article we will examine Puerto Rico Act 20 incentives and Act 22 incentives from every angle.

Sometimes effective tax planning can help avoid these taxes. This Tax Alert is the first of two alerts that will summarize some of the. Tax Incentives ACT 27.

29 1340 which prohibits sex- based discrimination and Puerto Rico Act 17 of April 22 1988 PR. The main body of domestic statutory tax law in Puerto Rico is the Código de Rentas Internas de Puerto Rico Internal Revenue Code of Puerto Rico. The goal of tax planning is to legally limit minimize and if possible avoid US tax while also.

The Foreign Account Tax Compliance Act FATCA is a 2010 United States federal law requiring all non-US. Puerto Rico Act 69 of July 6 1985 PR. Heavy-Duty Vehicle Replacement or Repower.

South of Cidra and Caguas. On June 30 2022 Governor Pedro Pierluisi signed into law House Bill no. All federal employees those who do business with the federal government Puerto Rico.

Moving to Puerto Rico. We will break down the programs discuss how the tax incentives work go over what you must do to. Any natural or legal person doing business in Puerto Rico who makes payments Payer for rendered services must deduct and withhold 29 from the payment made to Foreign non-resident individuals and foreign corporations and partnerships that are not registered in the Puerto Rico State Department to engage in trade or business in Puerto Rico.

Moving to Puerto Rico. View foreclosures in Puerto Rico 30-50 below market value and get an amazing deal. McV attorneys have a strong Act 60 practice for Export Services Commerce and for Individual Investors formerly Acts 2022 counseling and advising clients seeking to relocate to Puerto Rico to benefit from these tax incentives.

We have the most exclusive inventory in Beachfront Properties in Puerto Rico. Puerto Rico Incentives Code 60 for prior Acts 2020. The code organizes commonwealth laws covering commonwealth income tax payroll taxes gift taxes estate taxes and statutory excise taxes.

They are innovators in technology energy finance and health care. We recognized that in order to become one of Puerto Ricos leading law firms we had to partner with our clients and provide them with smart cost-efficient business-savvy legal advice. In addition to attract investment Puerto Rico enacted two tax acts Act 20 and Act 22.

Territory but it has its own tax system. SB 1121 Puerto Rico Energy Public Policy Act p. Estado Libre Asociado de Puerto Rico lit.

Free Associated State of Puerto Rico is a Caribbean island and unincorporated territory of the United StatesIt is located in the northeast Caribbean Sea approximately 1000 miles 1600 km. Puerto Ricos lucrative tax incentives constitute a further reason to purchase property on the islandin fact the 2019 enactment or Puerto Ricos Act 60 has made the. This ultimate guide covers Puerto Rico tax incentives Act 20 and Act 22.

Tax Exemptions Act 2022. Tax Exemptions Act 2022. In addition to provid ing transition rules for the Act 154-2010 Act 154 excise tax the new Act 52-2022 Act 52 incorporates amendments to the Puerto Rico Internal Revenue Code of 2011 as amended PR Code.

Our clients run the gamut from local entrepreneurs to multi-national Fortune 500 companies. That means that in general bona fide residents of Puerto Rico who receive decrees for Act 60 formerly Acts 20 and 22 and other Puerto Rican tax incentives no longer have to deal with the IRSthey deal only with the Puerto Rican tax system which can be remarkably favorable for those holding tax. The incentives range from tax credits or rebates to fleet acquisition goals exemptions from emissions testing or utility time-of-use rate reductions.

Formerly known as Act 20 and now a chapter under Act 60 tax incentives have been designed specifically for companies to establish and expand their export services businesses from Puerto Rico. The Puerto Rico Energy Public Policy Act mandates that the Commonwealth obtain 40 of its electricity from renewable resources by 2025 60 by 2040 and 100 by 2050. Act 20 and 22 tax incentives have been replaced by Act 60 as of January 1 2020.

As you see Puerto Rico tax incentives come with specific requirements and limitations. Puerto Rico may be a US. This is a health insurance plan from the 2022 Act Society a society created by and for the recipients of Puerto Ricos many tax incentives.

Tax Incentives ACT 27. 2829 However as federal tax incentives phased out in 1996. 22 accessed November 21.

Puerto Rico Real Estate Puerto Rico Luxury Real Estate 4 Sale. You should use common sense and rely on your own legal counsel for a formal legal opinion on Puerto Ricos tax incentives maintaining bona fide residence in Puerto Rico and. Foreign financial institutions FFIs to search their records for customers with indicia of a connection to the US including indications in records of birth or prior residency in the US or the like and to report such assets and identities of such persons to the US.

Officially Cayey de Muesas is a mountain town and municipality in central Puerto Rico located on the Sierra de Cayey within the Central Mountain range north of Salinas and Guayama. Educators and Trainers Can See Big Tax Breaks in Puerto Rico Under Act 60. Still for people who want to live on the island.

Treasury action on Jan. Act 20 and 22 tax incentives have been replaced by Act 60 as of January 1 2020. You dont need to join the 2022 Act Society to sign up for the MCS health insurance plan but membership does come with several additional benefits for decree holders of Puerto Rico tax incentives.

Puerto Rico Tax Incentives.

Puerto Rico Tax Incentives Fee Increases Relocate To Puerto Rico With Act 60 20 22

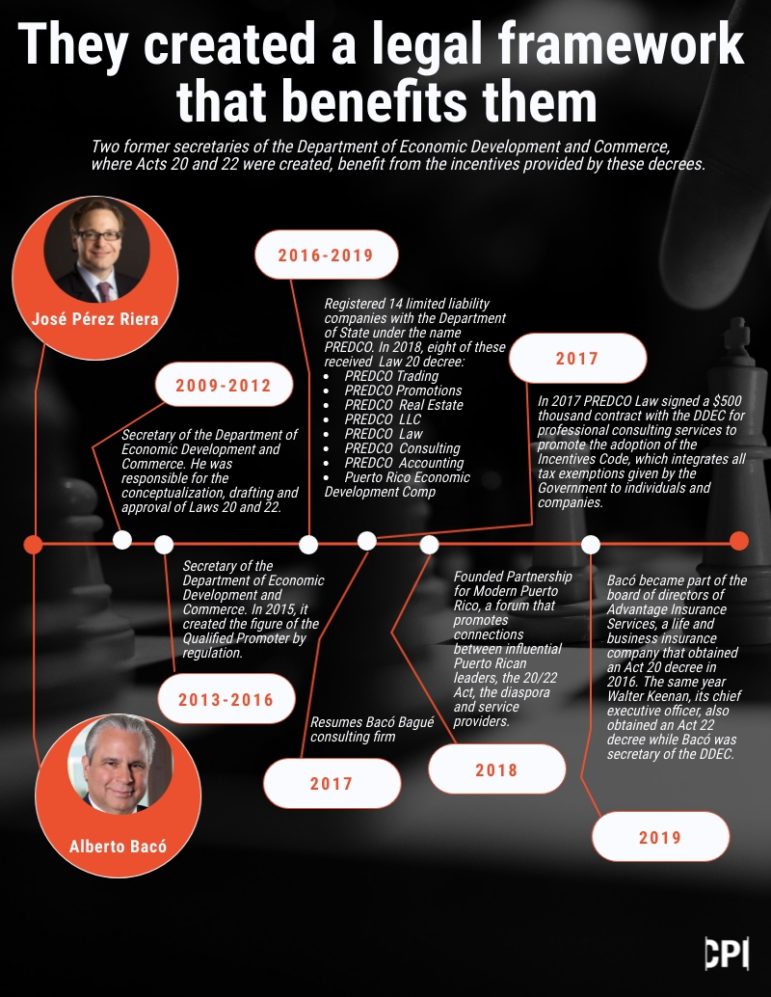

Centro De Periodismo Investigativo Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativo

Centro De Periodismo Investigativo Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativo

Saving Puerto Rico By Reviving Long Lost Tax Incentives The Hill

Gov T Revokes 121 Tax Incentives Decrees Under Act 22 News Is My Business

5 Tax Matters You Should Consider Before Relocating To Puerto Rico Kevane Grant Thornton

Centro De Periodismo Investigativo Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativo

Act 20 22 Act 73 Puerto Rico Puerto Rico Vieques Luxury Property For Sale

Omnia Economic Solutions Solutions Fictional Characters Character

Why People Are Moving To Puerto Rico In 2018 Act 20 Act 22 Youtube Puerto Rico Why People Acting

Centro De Periodismo Investigativo Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativo

Centro De Periodismo Investigativo Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativo

Gov T Revokes 121 Tax Incentives Decrees Under Act 22 News Is My Business

Save On Corporate Tax In Puerto Rico With The Act 60 Export Services Tax Incentive Youtube

Stunning 4k Drone Footage Of Puerto Rico Travel Leisure Travel And Leisure Puerto Rico Puerto